delayed draw term loan accounting

Depending on its facts and circumstances the borrower may be required to. I the first day on which the aggregate amount of the Delayed Draw Term Loans advanced hereunder is equal to 25000000 ii the date that is the eighteen 18 month anniversary of the Closing Date and such earlier date on which the.

7 3 Classification Of Preferred Stock

Like revolvers delayed-draw loans carry fees on the unused portion of the facilities.

. Delayed draw term loans are usually valued at very large amounts. The panel will review the evolving uses of delayed draw term loans DDTLs in leveraged buyouts LBOs and other private equity transactions and critical points of negotiation including conditions precedent to making draws ticking fees loan term and fronting arrangements in. The facilities total over 35MM and included acquisition roll-up financing term debt and a delayed draw term loan.

Furthermore on March 18 2022 Celanese entered into a term loan credit arrangement the Term Loan Credit Arrangement pursuant to which lenders have committed to provide a senior unsecured term loan facility in an aggregate principal amount of 15 billion the Term Loan Facility consisting of a tranche of delayed-draw term loans due 364 days from issuance in an. This CLE course will discuss the terms and structuring of delayed draw term loans. 3413 Delayed draw term loan When a loan modification or exchange transaction involves the addition of a delayed draw loan commitment with the same lender we believe it would not be appropriate to include the unfunded commitment amount of delayed draw term loan in the 10 test since the commitment is not funded on the modification date.

Should the company draw on its delayed draw term loan it would face a modest maturity wall in 2024 consisting of 300 million in unsecured bonds plus the DDTL maturity. These ticking fees start at 1. Further negotiations may be around conditionality for the delayed draw and use of proceeds.

The increased use of the DDTL in the leveraged loan market is also driving longer commitment periods. Term loans are best suited for long-term investments such as the purchase of fixed assets. NEW YORK May 17 2022 PRNewswire -- Tillman Networks TN a leading provider of network infrastructure services across the United States has closed on a delayed draw term loan facility with.

Delayed Draw Term Loan Availability Period means the period from and including the Closing Date and ending on the earliest of the following. In this scenario we believe it would be appropriate for the reporting entity to amortize the commitment fee on a straight-line basis over the access period. This guide provides a summary of the guidance relevant to the accounting for debt and equity instruments and serves as a roadmap to the applicable accounting literature.

For example they could range from 1 million to over 100 million. Delayed draw term loans may come in terms of say three or five years with interest-only periods such as six months to one year. Drawn DDTL costs mirror term loan spreads.

This contrasts with commitment fees on revolvers of 50bp. Represented a regional financial institution in providing over 35MM of working capital revolving facilities cap-ex and equipment facilities and term debt to a borrower group of over 80 entities in the heating and natural gas industry. An accordion feature is a type of option that a company can buy that gives it the right to increase its line of credit.

These loans should ideally be used for project financing with forecasted cash inflows in the future. This AMENDED AND RESTATED DELAYED DRAW TERM LOAN AGREEMENT dated as of October 18 2019 the Restatement Date is by and among SHIFT TECHNOLOGIES INC a Delaware corporation Shift Technologies SHIFT OPERATIONS LLC a Delaware limited liability company and SHIFT FINANCE LLC each a Borrower and together with any other person that becomes. FG 443 was updated to provide additional commentary on dividends in kind.

DDTLs used to be available for three six or 12 months but the DDTLs in the recent deals are available for up to two years. Since businesses expect to create value over the long-term with the fixed assets they should fund these projects with a long-term loan. Ad Browse Discover Thousands of Business Investing Book Titles for Less.

FG 3413 was added to discuss modifications or exchanges of delayed draw term loans. Withdrawal periods could be every few months or every year. A adjust the carrying amount of the loan b change the amount of interest expense recognized in the income statement on a going-forward basis or recognize a gain or loss in the income statement and or c expense some of the costs incurred to execute the changes and or defer and amortize.

FG 434 was added to discuss modifications or exchanges of common stock. In other instances the reporting entity may have entered into the delayed draw simply to have access to the funds but without any current intention to draw down the debt. B If when the loans made hereunder are repaid in full the Lost Interest has not been fully recaptured by such Lender pursuant to the preceding paragraph then to the extent permitted by law for the loans made hereunder by such Lender the interest rates charged under Section 26 hereunder shall be retroactively increased such that the effective rate of interest under the.

Portions of this guide assume that ASU 2020-06 Debt-Debt with Conversion and Other Options Subtopic 470-20 and Derivatives and Hedging-Contracts in an Entitys Own Equity Subtopic 815-40 have. Chapter 4 Common stock and dividends FG 433 was added to discuss common stock issuance costs. They differ from revolving credits in that once repayments are made they cannot be re-borrowed.

Delayed Draw Term Loan Ddtl Overview Structure Benefits

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

Tree Line Capital Partners Linkedin

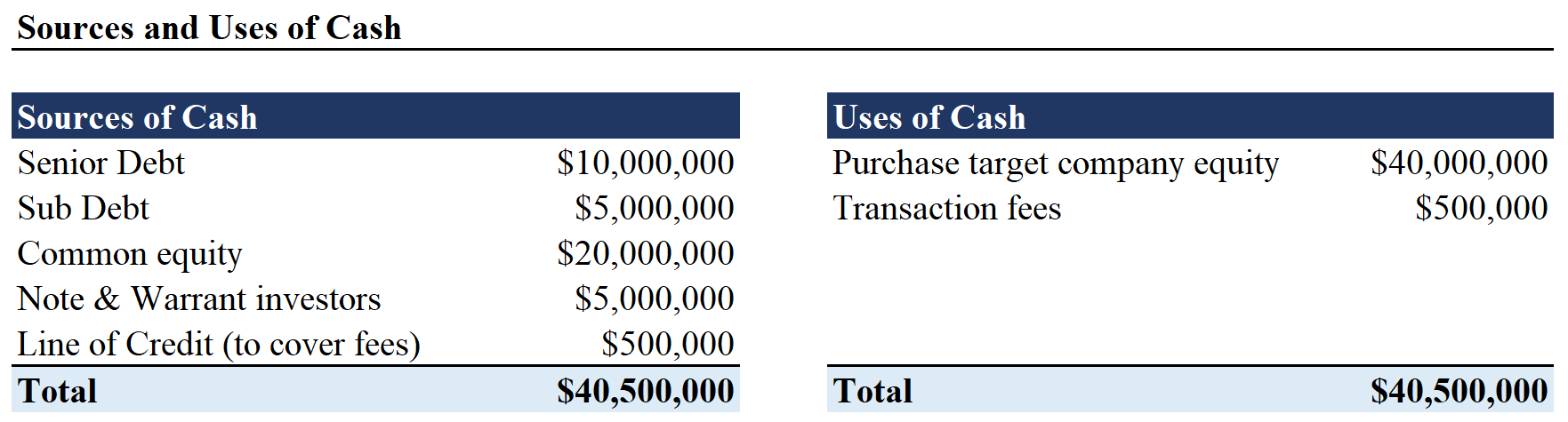

Sources And Uses Of Cash How To Build A Sources Uses Table

Financing Fees Deferred Capitalized Amortized

7 3 Classification Of Preferred Stock

Debt To Equity Ratio How To Calculate Leverage Formula Examples

Leveraged Buyout Model Advanced Lbo Test Training Excel Template

Corporate Banking Sell Side Handbook

Delayed Draw Term Loans Financial Edge

Financing Fees Deferred Capitalized Amortized

Financing Fees Deferred Capitalized Amortized

Leveraged Buyout Model Advanced Lbo Test Training Excel Template

:max_bytes(150000):strip_icc()/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)